vermont department of taxes property valuation and review

You Can See Data Regarding Taxes Mortgages Liens Much More. Vermont department of taxes division of property valuation and review vermont department of education colchester school district fanny allen holdings inc.

Jill Remick Director Of Property Valuation And Review State Of Vermont Linkedin

Appeals to the Director of Property Valuation and Review - Handbook 25571 KB File Format.

. State government websites often end in gov or mil. The Division of Property Valuation and Review PVR conducts an annual Equalization Study of all the municipal grand lists. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of dispersion COD for each municipality in Vermont.

The primary purpose of the Equalization Study is to assess how close the. This option is an administrative proceeding conducted by an independent hearing officer appointed by the Tax Department and paid by the Tax Department but who otherwise operates independently. State of VT Tax Department Website.

State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To. Jill Remick Director Property Valuation and Review Division Vermont Department of Taxes. Locate a District Advisor.

Vermonts statewide education property tax is unique. PVR Annual Report - Based on 2017 Grand List Data Revised March 29 2018. The state education property tax is based on each municipalitys grand list of properties.

PVR Annual Report - Based on 2019 Grand List Data. If you have trouble finding the district advisor assigned to your town please call the help desk at 802 828-6887. Use the interactive district advisors map below or locate your town using the table.

In 2015 the Vermont legislative session Act 57 Section 55 required the Director of Property Valuation Review PVR to. PVR supports computer software programs used locally for grand list valuation and property tax. The gov means its official.

Appeal of the town of docket no. Act 60 Income Tax. Job Description The overarching responsibility of the lister and frequently municipal assessors is assessment equity on the grand list.

- Property Valuation Review Division. Property Valuation. 802-828-5860 - Taxpayer Services Division.

The report shall include the rate per dollar and the amount of all taxes assessed in each and all of the. Appeal from the board of civil authority is an appeal to the Division of Property Valuation and Review at the Department of Taxes. Property Valuation and Review Division Vermont Secretary of States Office Vermont Tax Department Redstone Building 133 State Street 26 Terrace Street Drawer 09.

Vermont raises education funds through several tax sources including a state education property tax. Honorable Jill Krowinski Speaker of the House Honorable Becca Balint Senate President Pro Tem From. State Property Tax Forms.

By Department of Taxes. As a Vermont Property Assessor through the Property Valuation and Review PVR Vermont Department of Taxes is highly recommended to establish professionalism and commitment to the position. Before sharing sensitive information make sure youre on a state government site.

After the grand list is finalized each year the Property Valuation and Review Division of the Department of Taxes is required to report on the tax rates in every municipality the value of all exempt property and the appraisal practices and methods used throughout Vermont. State of Vermont Department of Taxes Division of Property Valuation and Review 133 State Street Montpelier VT 05633-1401. By Department of Taxes.

17 rows On an annual basis the Director of the Property Valuation and Review shall deliver to the Speaker of the House of Representatives and to the President Pro Tempore of the Senate copies of an annual report including in that report all rules issued in the preceding year. By Department of Taxes. District Advisors Listers and Assessors Municipal Officials.

PVR Annual Report - Based on 2018 Grand List Data. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of dispersion COD for each school district in Vermont. S0933-10 cnc colchester pace vermont inc.

TOEC is planned in cooperation with the Vermont Department of Taxes Property Valuation and Review Division Vermont AARP the Vermont League of Cities and Towns the Vermont Assessors and Listers Association the Vermont Department of Libraries and the University of Vermont Center for Rural Studies. Defendants in re. Honorable Mitzi Johnson Speaker of the House Honorable Tim Ashe Senate President Pro Tem From.

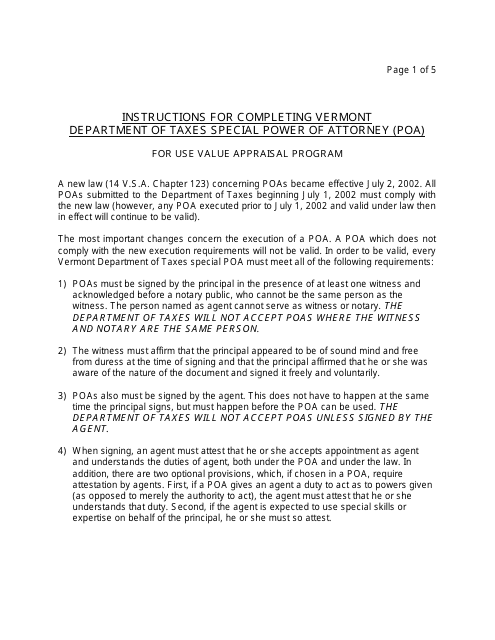

Plaintiff v. Appeals to the Director of Property Valuation and Review. Publish guidance on how to assess land permanently encumbered by a conservation easement or subject to use value appraisal by April 15 2016.

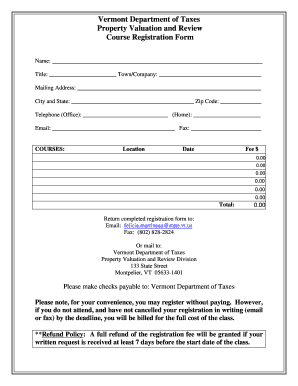

The EEPVs determined as part of the 2020 equalization study are a measure of the property dollar value of a municipality. Ad Get a Vast Amount of Property Information Simply by Entering an Address. Courses presented by Property Valuation and Review are offered free of charge to municipal officials.

State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To. Farnham Director Property Valuation and Review Division Vermont Department of Taxes Date. Grants are available for municipal officials who must commute 50 miles or more one way and applications must be received before the date of the events.

The Division of Property Valuation and Review PVR staff which includes both office staff and traveling District Advisors provides support to municipalities in developing and administrating property tax policies and related programs at the local level.

Fillable Online Tax Vermont Vt Form Property Valuation And Review Pvr Tax Vermont Gov Fax Email Print Pdffiller

Audit Finds Few Problems With Barre Tif Vermont Business Magazine

We Offer One Of The Easiest To Use Search Systems In The Real Estate Marketplace Https Www Propertyrecord Property Records Real Estate Humor Home Appraisal

Vermont Department Of Taxes Facebook

Municipal Officials Department Of Taxes

Home Valuation Form Fill Online Printable Fillable Blank Pdffiller

Municipal Officials Department Of Taxes

Vermont Special Power Of Attorney Use Value Appraisal Program Download Printable Pdf Templateroller

Publications Department Of Taxes

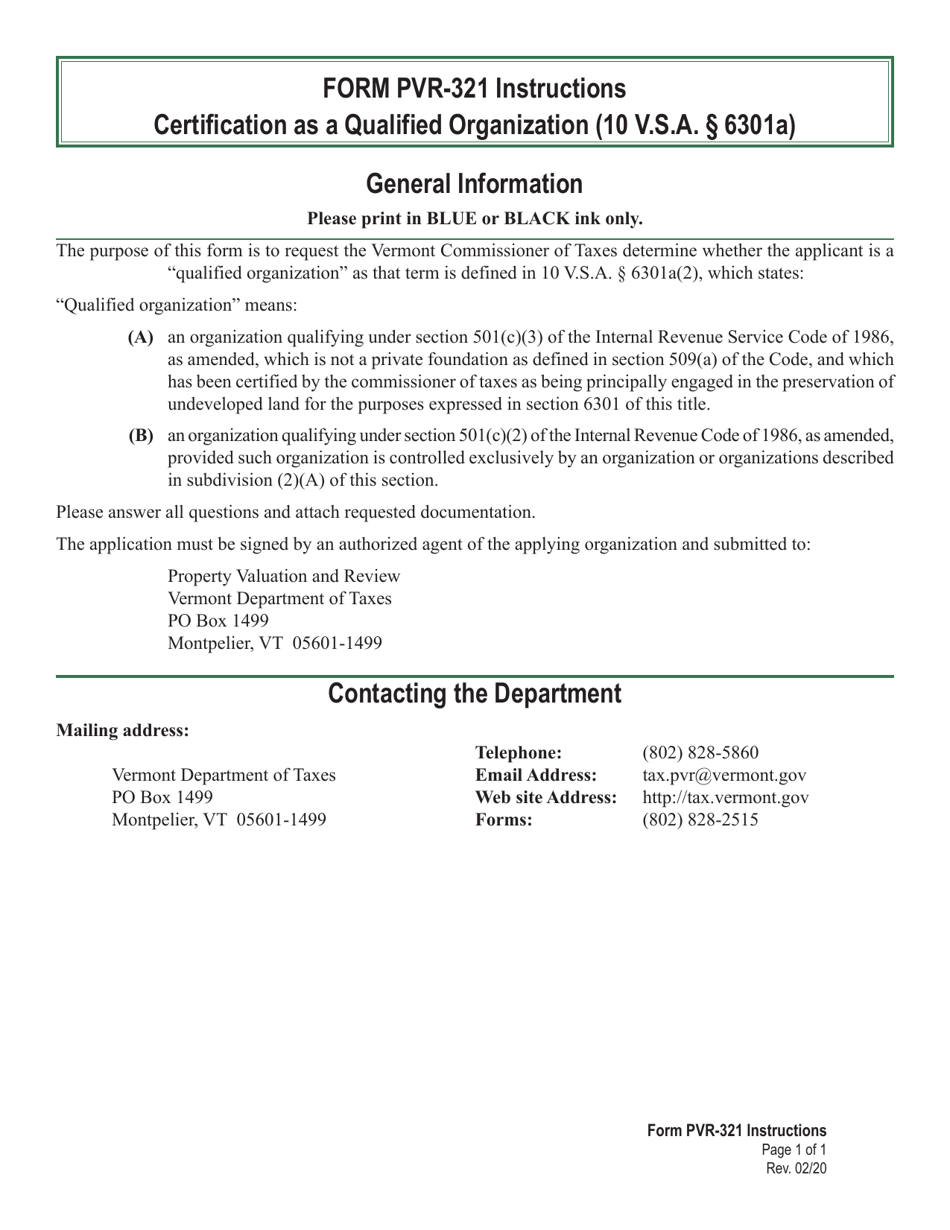

Vt Form Pvr 321 Download Fillable Pdf Or Fill Online Application For Certification As A Qualified Organization 2020 Templateroller

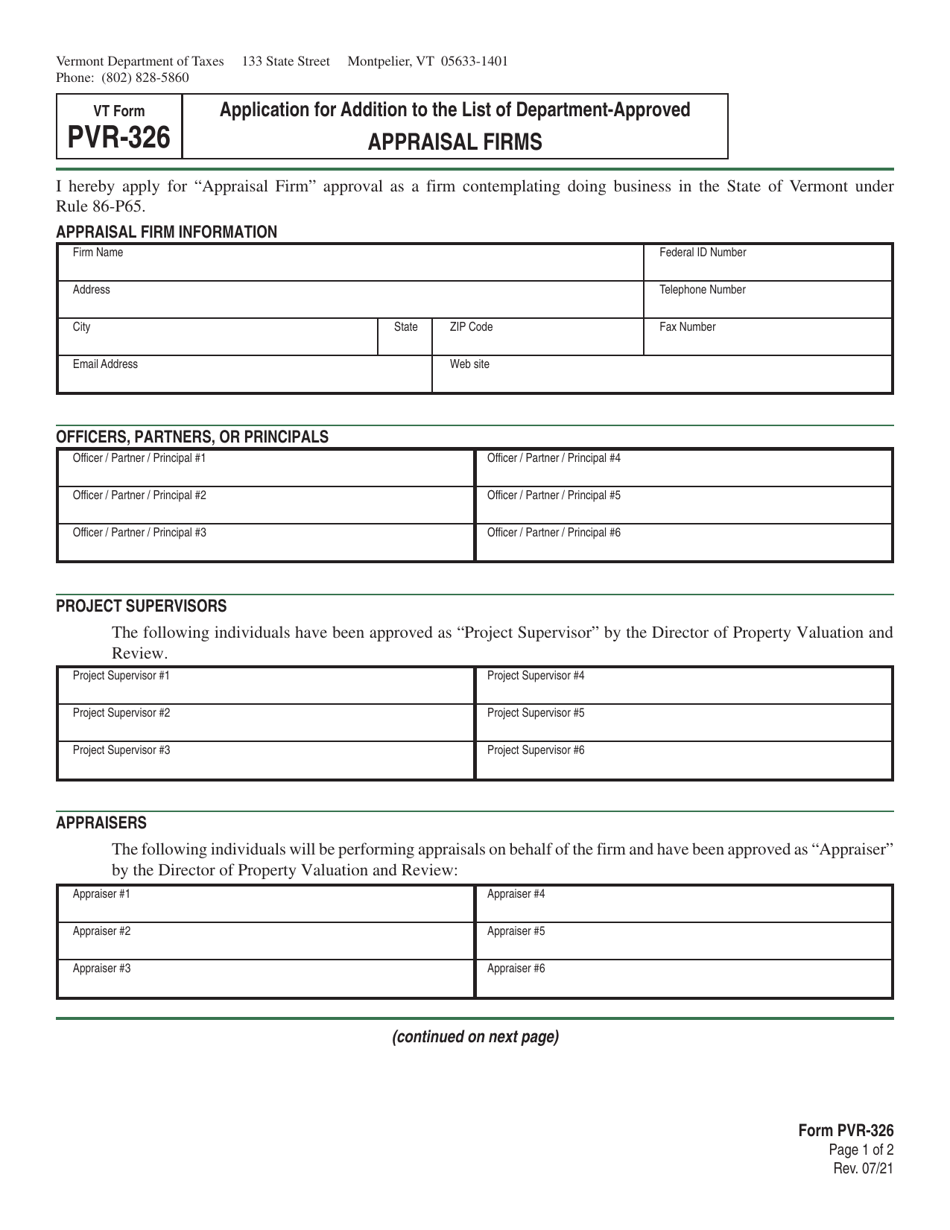

Vt Form Pvr 326 Download Printable Pdf Or Fill Online Application For Addition To The List Of Department Approved Appraisal Firms Vermont Templateroller

Govpetershumlin Senatorleahy Sensanders Peterwelch Vt 1 In Home Repossessions Up 280 If Vt Economy Rosy Why Montpelier Vermont Restoration